Your initial intention when making an investment is to make money. Financial planners and consultants will tell you that the simplest and surefire way to make your money grow over time is through compounding your returns or your interest. Doing so does not involve any difficult financial strategy or timing, all you need to do is sit back and relax and let you money grow.

Your initial intention when making an investment is to make money. Financial planners and consultants will tell you that the simplest and surefire way to make your money grow over time is through compounding your returns or your interest. Doing so does not involve any difficult financial strategy or timing, all you need to do is sit back and relax and let you money grow.

But if this is the case, why aren’t we all rolling in dough if the simple was as plain as the nose on your face? Many will advise you not to put your eggs in one basket. Those who are risk takers in investments jump from one investment to another if a better opportunity presents itself. This could be a very lucrative strategy when you want your money to grow. But for those who is not aware of how the investment world works and those who do cannot afford to lose their hard earned money will benefit more from taking an investment with high returns and watch the interest compound.

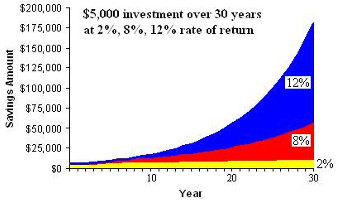

Compounding your interest is a very powerful money making tool which allows you to earn money through reinvesting your earned interest. If for example, you initially invest $100 at an annual interest of 5%, your money will earn $5 on the first year without you lifting a finger. By the beginning of the next cycle, you will have $105 on your account and this will earn $5.25 on the 2nd year of your savings in your account giving you a total of $110.25. Reinvesting your earnings and refraining from withdrawing your earnings will increase the amount that you invest each year.

Although your money will grow without any activity on your end, there are some ways for you to earn more by taking an active part in making your wealth build:

- Since the growth of money using compounded interest is quite conservative, it will benefit you to start early so that your money will be given more time to earn money. If you have a small amount of money put away, it wouldn’t hurt to keep that money locked in on an investment and just allow it to grow.

- You can also take advantage of the power of compounding interest by adding to your investment every so often. Make a habit of putting away a fixed amount of money every year or every month for your investment. Adding or increasing the amount of money that you have invested will quickly build you wealth as your compounded earnings increase.

- If you have already invested in mutual funds or stocks which offer a higher interest rate, you can reinvest your earnings there to make the most out of the magic of compounded returns. Transferring your returns will increase your investment base on a new income avenue. This can be especially beneficial to you if you have not invested in a tax sheltered account.

As in any form of investment, you should look carefully at your options and both the benefits and disadvantages of each investment avenue. A tax deferred or tax free account like a Traditional or Roth IRA will really let you see the effects of compound interest. Watching your investment grow through compounding interests will be one of the guaranteed ways for you to save some money for retirement or any financial plans that you may have.